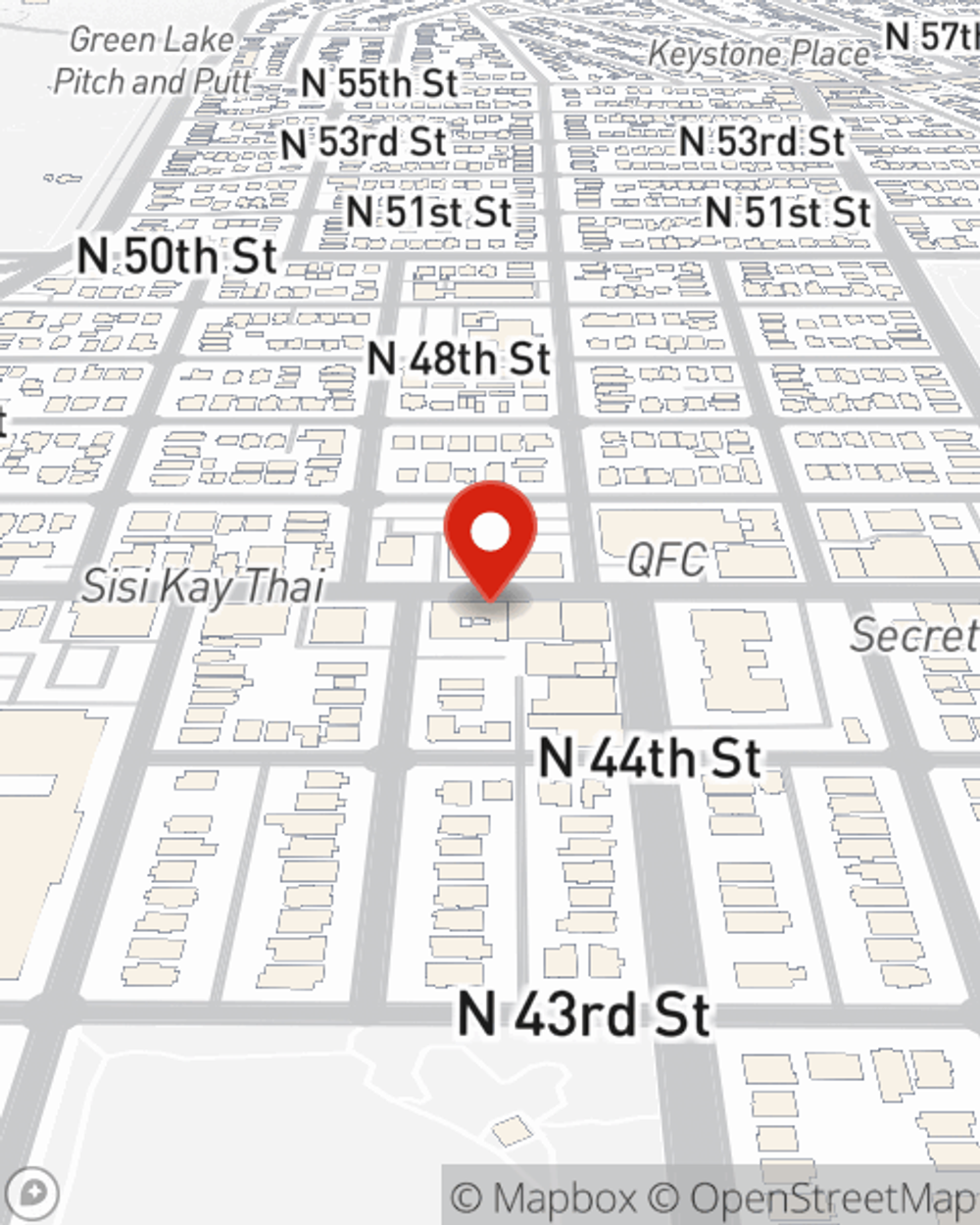

Renters Insurance in and around Seattle

Looking for renters insurance in Seattle?

Coverage for what's yours, in your rented home

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Think about all the stuff you own, from your dresser to entertainment center to lamp to bedding. It adds up! These valuables could need protection too. For renters insurance with State Farm, you've come to the right place.

Looking for renters insurance in Seattle?

Coverage for what's yours, in your rented home

There's No Place Like Home

Renting is the smart choice for lots of people in Seattle. Whether that’s a house, a townhome, or an apartment, your rental is full of personal possessions and property that adds up. That’s why you need renters insurance. While your landlord's insurance probably covers water damage to walls and floors or a break-in that damages the door frame, that doesn't cover the things you own Finding the right coverage helps your Seattle rental be a sweet place to be. State Farm has coverage options to match your specific needs. Thank goodness that you won’t have to figure that out alone. With personal attention and fantastic customer service, Agent Kent Christianson can walk you through every step to help you build a policy that guards the rental you call home and everything you’ve invested in.

More renters choose State Farm® for their renters insurance over any other insurer. Seattle renters, are you ready to discover the benefits of a State Farm renters policy? Call or email State Farm Agent Kent Christianson today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Kent at (206) 632-8000 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.

Kent Christianson

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Chillin’ and grillin’: Check out our safety tips for outdoor grilling with charcoal and gas

Help prevent accidents and disasters by knowing the risks, knowing what to watch out for and by following the steps for safe grilling.